Bài mới tinh trên Bloomberg tặng các bác. Bên anh hàng xóm giá nhà lại mới giảm, chính phủ đã cho phép các tỉnh dỡ bỏ khung giá nhà mới (trước đây các tỉnh được quy hoạch giá nhà mới nên giá nhà mới không thể hạ). Nay do giá nhà đã xây (thị trường thứ cấp) giảm kinh quá, nhà mới xây không bán đươc, nên các tỉnh cho phép các chủ đầu tư được phép tự giảm giá nhà.

China Unleashes Rapid Drop in New-Home Prices With Relaxed Curbs

- At least 10 cities relaxed, removed new home price guidance

- New projects in Beijing, Shenzhen have also slashed price

A price war is spreading across China’s new-home market, as local governments dial back on intervention and developers race to recoup cash.

In Beijing, a sudden 18% price cut in May at a mid-sized residential project on the city’s outskirts has forced adjacent new developments to follow suit, according to people familiar, who requested not to be named because the matter is private. Near the southern border, the Shenzhen government approved a 29% cut in unit prices for a complex compared with a year ago, according to other people familiar.

After intervening for years, at least 10 city governments have relaxed or scrapped new-home price guidances to let market demand play a bigger role, according to China Index Holdings Ltd. and public statements.

While it’s mostly smaller cities that have announced the moves, the examples in Beijing and Shenzhen show that even bureaucrats in megacities are starting to relax prices on a case-by-case basis.

The move is expected to drive more developers to cut prices as they benchmark against the second-hand market that’s seen a much steeper decline. That will help remove longstanding market distortions created by government meddling, even if it keeps some buyers on the sidelines as they wait to see how far new-home values will fall.

“This will likely translate into more downside to home prices in most cities,” said Kristy Hung, a Bloomberg Intelligence analyst. It “would be detrimental to sentiment as potential buyers wait for prices to bottom before getting into the game.”

That spells trouble for the incremental

improvement in home prices seen in July. The housing ministry in Beijing and Shenzhen didn’t respond to respective queries.

Price Intervention

Other cities that have joined the trend include Zhengzhou, the capital of central China’s Henan province. Home to one of

Apple Inc.’s largest iPhone manufacturing sites, it

ended the use of price guidances for new homes in July, effectively allowing real estate firms to set values based on market demand. Wuhan

followed suit the same day.

For years, China’s housing authority tinkered with the price range at which new homes were sold through a “

pre-sales permit.” The approach kept new-home prices in the biggest cities in check since late 2016 following a property

frenzy. But when second-hand homes went into freefall, the arrangement kept new-home values abnormally

resilient. That in turn made it even harder for companies to sell their inventory.

“Restrictions on home price declines have hindered developers’ sales since mid-2021,” said Chen Wenjing, a research director at property agency

China Index Holdings. “Easing or removing such restrictions will allow them to set prices reasonably.”

In a fundamental shift, existing-home sales

overtook that of new ones in China for the first time last year, as buyers hunted for better bargains.

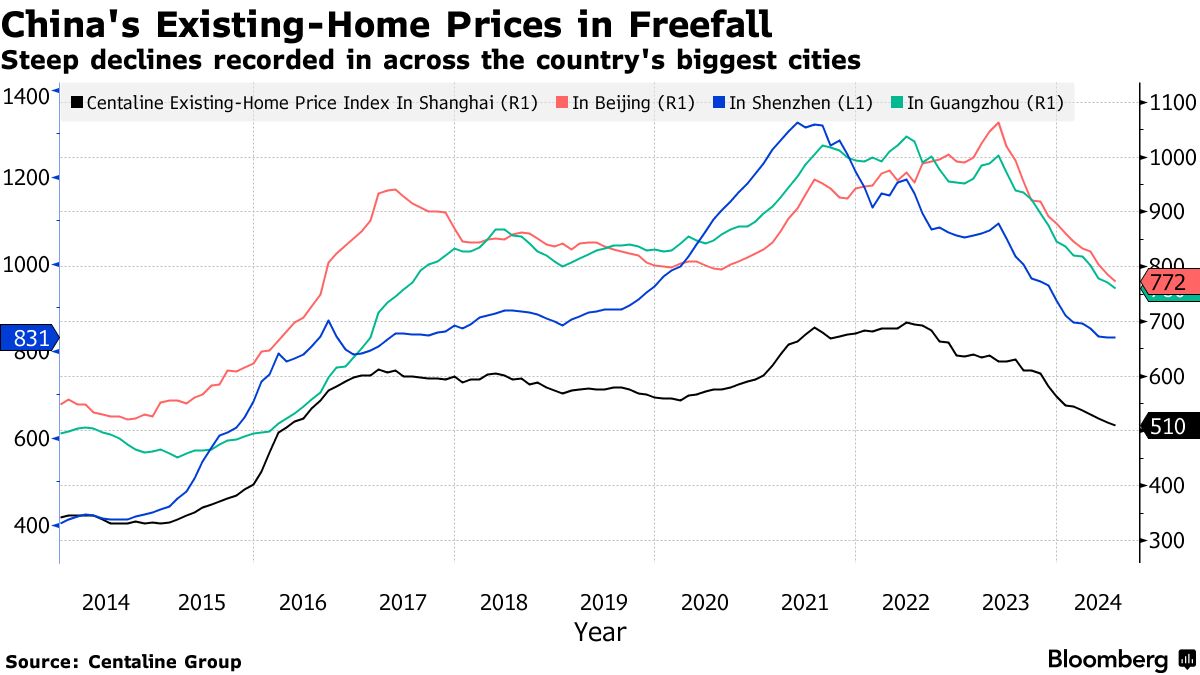

New-home values have declined about 7.2% from June 2021, about half of the 13.6% drop seen in

existing-home prices.

China New-Home Prices Have Fallen Less Than That of Used Ones

Local housing authorities controlled new home prices

Source: National Bureau of Statistics of China, Bloomberg

Prices of second-hand homes in Shenzhen, once China’s

least affordable city, have plunged 37% from a peak in May 2021, according to Centaline Group. They’ve tanked by about 27% in Beijing, Shanghai and Guangzhou from their respective peaks.

The bargains pushed Shenzhen’s existing-home sales in July to the highest by monthly volume in more than four years, according to the city’s biggest real estate agency Leyoujia. The same month, its new-home sales shrank 11% by units from a month earlier.

Similarly, the slump of nationwide new-home sales deepened in July.

Many of the cash-strapped developers, who have been in default for more than a year, are counting on sales to reassure debt holders and fight off liquidation.

At least 20 Chinese developers have faced wind-up petitions, according to data compiled by Bloomberg.

Dexin China Holdings Co. in June became the latest builder to receive a

liquidation order from a Hong Kong court, following China Evergrande Group and

Jiayuan International Group Ltd.

Developer Liquidity Stress

In addition, about 80 out of the top 200 real estate companies operating in China have been mired in default, according to data compiled by Bloomberg. More could follow as new-home sales haven’t fully recovered, China Real Estate Information Corp warned in note on Aug. 8.

Local governments are piling on the pressure, with the Guangdong provincial government

urging developers to raise funds via asset disposal and not “lie flat,” a popular term referring to lack of effort.

China Home Sales Slump Drags On

Source: China Real Estate Information Corp.

As new-home prices begin to come down in China’s biggest cities, the government may be reaching similar conclusions even though such policies have yet to be officially announced.

In May, Beijing’s Oak Bay by state-backed builder

China Resources Land Ltd. cut its asking price for some units to 54,000 yuan per square meter, about 18% lower than when it debuted in September last year, according to people familiar.

Two nearby projects also had prices slashed. CSC Jiuyue Palace cut the prices of some units to 56,000 yuan per square meter. China Blossoms went further, offering selective units as low as 50,000 yuan per square meter, 31% lower than government-guided prices earlier, according to a sales agent.

In southern Shenzhen, “almost every new-home project” is on discount, according to a July note from Leyoujia.

“New-home prices will be more ‘reasonable’ once they’re allowed to fluctuate only based on supply and demand,” said Yan Yuejin, vice president of Shanghai E-house’s research arm. “Removing restrictions on price setting heralds thorough loosening in real estate policies.”

.

.