Southeast Asia Smartphone Growth Continues to Climb Despite Sluggish 1Q15, IDC Finds

29 Jun 2015

KUALA LUMPUR, 29 June 2015 – The total smartphone shipments in the South East Asia (SEA) region reached approximately 24 million units in the first quarter of 2015 (1Q15), posting a year-over-year (YoY) growth of 65.6%, but a sequential decline of 9.5%, according to International Data Corporation (IDC) Asia/Pacific Quarterly Mobile Phone Tracker.

"As expected, there has been a significant growth of smartphones since the availability of cheaper makes in the market, most of which came from China and local vendors. As of 1Q15, smartphones accounted for about three-fifths of the total mobile phone market share as opposed to the first quarter of 2014 (1Q14), when feature phones held that same larger share," said Jensen Ooi, market analyst for IDC's Client Devices team in Malaysia.

The sequential decline in emerging markets in the region was mainly attributed to excess inventory from the previous quarter and negative economic conditions in some of these markets. The only mature market,

Singapore, recorded a decline as well; however, it was an expected seasonal decline due to the culmination of the year-end holiday and shopping period.

Thailand and

Myanmar stood out as the only two emerging markets to record growth. In Thailand, local mobile operators partnered with smartphone vendors as part of a rushed initiative to convert 2G network users to the more advanced 3G network before September 2015. In Myanmar, the significantly reduced prices of SIM packs for the general public and improved coverage of 3G network have driven strong demand for smartphones.

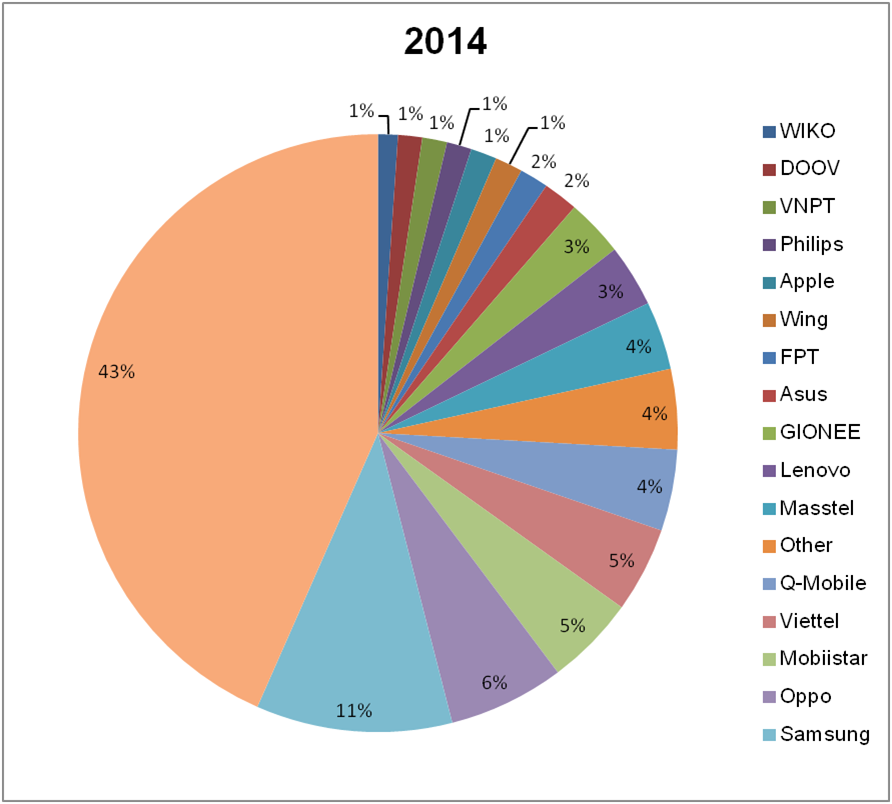

Figure 1

While overall shipments declined slightly quarter over quarter (QoQ), significant YoY changes can be seen on several factors that influence the purchase decision of SEA end users. As of 1Q15:

- Smartphones with 4G capability grew, accounting for 25% of the total smartphone market share compared with 16% in 1Q14.

- Smaller screen smartphones can be seen losing its popularity as <4" screen sizes smartphones have continued to decline holding only a mere 6% market share as opposed to 18% in 1Q14. SEA end users have a stronger preference toward smartphones with screen sizes between 4.5" to <5.5" as the market share for these sizes stand at 53% compared with only 32% back in 1Q14.

- Smartphones with the price band of US$75 to <US$200 remained as the comfortable price range, holding 51% market share, marginally higher than 1Q14 that recorded 46% market share.

"A sluggish first quarter is no cause for concern, considering the record high shipments in the last quarter of 2014,” said Daniel Pang, senior research manager for ASEAN Client Devices. The outlook for 2015 is bright and will generate lots of excitement as established vendors defend their turf against a tidal wave of new and existing China and local vendors. With new mobile innovations also continuing to emerge, consumers are going to be the real winners.

IDC forecasts smartphone shipments to reach approximately 100 million units in 2015, registering a 21% increase over 2014.