- Biển số

- OF-110827

- Ngày cấp bằng

- 29/8/11

- Số km

- 18,162

- Động cơ

- 1,096,850 Mã lực

Thì h thấy tài khoản nẩy số nhưng đếch được tiêu.Biết là vậy nhưng nó lên vẫn cứ là ngon với việc đầu tư số cp đó

Mà ai biết tương lai như nào

Thì h thấy tài khoản nẩy số nhưng đếch được tiêu.Biết là vậy nhưng nó lên vẫn cứ là ngon với việc đầu tư số cp đó

vol nhỏ lái lên nhiêu chả đượcTầm này cụ short có khi vỡ mồn ý

Có ba cây nên 1 h mà đánh lên x3 thì tốt nhất ngồi ngoài hóng thôi cụ ei.

Nhưng lái khiếp quá cụ nhể.vol nhỏ lái lên nhiêu chả được

kích fomo là xong

Ai cũng nghĩ ng khác fomo nên fomoVới cú tăng sốc đêm nay và volume > 14M (sẽ cao hơn nữa khi phiên giao dịch kết thúc), dường như FOMO game đã được kích hoạt. Với dự đoán VFS sớm chạm 5x thì kết quả phe Long "ai cũng sẽ có quà". Chúc các nhà đầu tư giữ được thành quả khi kết thúc FOMO game.

Mỹ không có biên độ nên lái thoải mái màNhưng lái khiếp quá cụ nhể.

Mai báo trí lên bài cứ gọi là hết năng suất.

Nó cứ tăng có khi lại có bài vf mua được thêm mấy hãnh xe nữa ý chứ

để tạo short squeeze, nếu có, thì nhóm nội bộ cũng phải bỏ tiền ra oánh lên, mà vol nhỏ nên làm gì cũng được. Bên Mỹ có trò quay tay trong ngày nữa.Hôm nay là short squeeze (bên bán khống bị vắt). Bác nào trade cà phê hay thấy trò squeeze này ở tháng gần (front month).

tuy vậy làm vài vòng thì cũng sẽ nhàm, hiệu ứng giảm điNhưng lái khiếp quá cụ nhể.

Mai báo trí lên bài cứ gọi là hết năng suất.

Nó cứ tăng có khi lại có bài vf mua được thêm mấy hãnh xe nữa ý chứ

Nó oánh lên làm mồi lửa, còn đâu ae short bị squeeze đua nhau mua cắt lỗ làm giá bốc hơn nữa.để tạo short squeeze, nếu có, thì nhóm nội bộ cũng phải bỏ tiền ra oánh lên, mà vol nhỏ nên làm gì cũng được. Bên Mỹ có trò quay tay trong ngày nữa.

Một trong 2 tờ báo tài chính hàng đầu thế giới, tờ báo kia là The Wall Street Journal.Báo Financial Times này có uy tín không các cụ

dài quá cụ ko đọc hết hả . đọc thử dòng e bôi đậmBáo Financial Times này có uy tín không các cụ

Beware, a 2023 Spac oddity

Vietnamese EV maker VinFast floats through the back door

REUTERS

Craig Coben is a former global head of equity capital markets at Bank of America and now a managing director at Seda Experts, an expert witness firm specialising in financial services.

Special purpose acquisition companies (Spacs) have fallen out of favour. Touted as an attractive way to list on the stock market, these blank-cheque firms have often merged with subpar companies at exorbitant valuations. Investors have now soured on the deals.

But last week the Vietnamese electric-vehicle maker VinFast seemed to defy the Spac-sceptics when it merged with Black Spade Acquisition Company at a $23bn valuation. The stock jumped on its Nasdaq debut, valuing the company at $85bn.

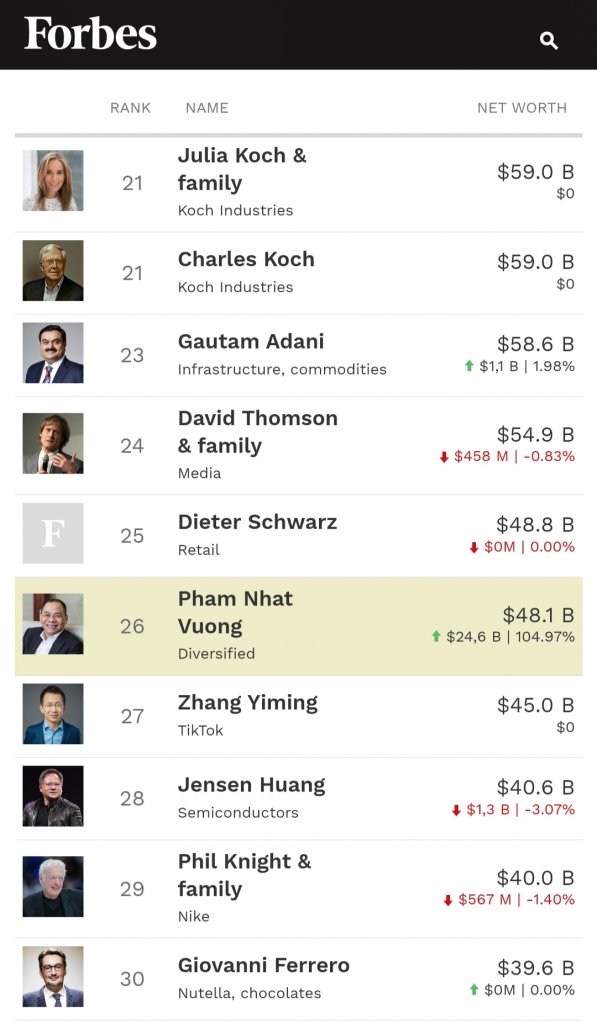

“Vietnamese EV maker worth more than Ford or GM after US listing,” headlined MainFT. Bloomberg said that the spectacular first-day pop “added $39bn to the net worth of the chairman Pham Nhat Vuong.” The stock has since snapped back, but with a $36bn market cap, the sugar-high from the listing still hasn’t worn off.

The press articles all mention that the chair controls 99 per cent of newly listed VinFast. But that’s not just an aside: it is the story. This is no conventional de-Spac; rather it resembles a backdoor listing into an empty listed shell. And the stock price is just an arbitrary number on a screen, not the market’s judgment of the company’s worth.

Reverse mergers into listed empty shells have a sketchy reputation. Most aren’t fraudulent but they give off bad vibes, conjuring up images of dodgy companies bypassing the national regulator to list on the stock exchange. Watchdogs around the world have sought to restrict them. Back in 2012 the SEC halted trading in almost 400 “dormant companies” after a wave of Chinese companies with dubious accounting had listed in the US via reverse merger. Last year, a Nasdaq OTC-listed deli in New Jersey was used as a shell company to list a bioplastics firm, resulting in the three promoters facing securities fraud charges.

Merging with a Spac is considered the “legitimate” way to effect a backdoor stock market listing. For starters, a Spac goes public with the express aim of merging with a future target. The Spac usually has 24 months to finalise a deal, and shareholders can both vote on the merger and redeem their shares to get their money back with interest. Spac teams often consist of seasoned dealmakers and respected business leaders, not spivvy chancers looking for a fast buck.

When a company merges with a Spac, it gets more than just a stock market listing. The Spac brings money and an immediate path to liquidity. This is different from an empty shell which may have little to no money or assets. The typical merger target is around 2-3 times the size of the Spac funds to counter the dilution from the 20 per cent sponsor “promote”. This also leaves enough shares for price discovery in the secondary market.

VinFast’s business combination with Black Spade is formally a de-Spac. Top-tier law firms have drafted the SEC filings, and all the procedural safeguards, including shareholder votes and redemption rights, have been scrupulously respected. But in substance the deal feels more like an old-school reverse merger.

For one thing, the Black Spade Spac — which raised $169mn at IPO — had only $13.6mn left after shareholder redemptions. That’s a derisory dowry for a $23bn marriage. For another, VinFast has less than one per cent free float, and trading volumes are low and falling. A stock market listing should provide price discovery and liquidity; VinFast shares have neither.

VinFast’s listing risks a repeat of the so-called “eejit trade”, made (in)famous in 2013 when the then-nationalised Allied Irish Bank briefly hit a $99bn market cap, making it Europe’s most valuable bank stock. At the time AIB had less than one per cent of its shares freely trading, resulting in an artificially (and ludicrously) inflated stock price. The Irish Finance Minister even warned investors against buying the stock.

The worry here is that retail investors might buy VinFast shares in the mistaken belief that the stock price reflects the collective market judgment. In fact, almost no market players have validated the valuation. After filing with the SEC, VinFast withdrew its IPO and so never tested investor appetite. And nearly all Spac shareholders redeemed for cash instead of taking VinFast shares. In June VinFast tried to raise $250mn via a PIPE (private investment in public equity), which is a common feature in de-Spacs, but dropped the idea.

According to the filings, VinFast and Black Spade alighted on the $23bn equity valuation by taking the forecast 2023 price-to-revenue multiple of EV maker Lucid Group, reducing it by 18 per cent to reflect a “new issue discount”, and applying it to the VinFast management incentive earnout revenue figure for 2023, which — we are clearly told — “is not intended to be a projection or forecast.” That does not sound like a feistily negotiated M&A outcome, much less a market verdict. In any case, there’s no fairness opinion on the valuation from a third-party financial adviser, even though they have become a “de facto requirement for de-Spacs”.

VinFast used the Black Spade Spac to get listed when it couldn’t find buyers for its stock. There’s no reason to suspect anything untoward, but the business combination has resulted in almost no proceeds, no price discovery for the stock and no secondary market liquidity. The line between legit and eejit has just got thinner.

- Tư duy coi sự tăng giá của VFS là vô lý, lố bịch, đó là tư duy của những người bình thường.đanh lên chậm rãi với vol tăng dần thì ok, chứ cái trò giật cục biên lớn thì chỉ đc coi là hàng rác, VFS chỉ trong 1 đêm tăng gần hết kỳ vọng dài hạn, quá lố bịch dù có tin tức gì hỗ trợ đi nữa.